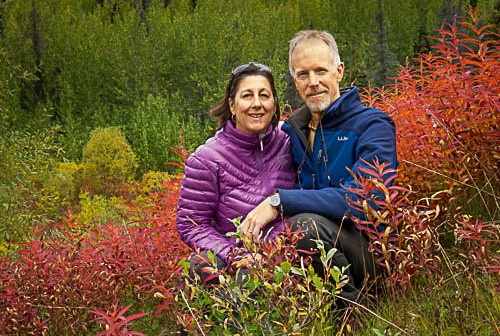

Putting CVCF in our will allows us to continue supporting the nonprofits of the Chilkat Valley in perpetuity. It also ensures that our money is being handled and spent responsibly.

–Jim & Anna Jurgeleit, Legacy Society for Alaska members

Leave a Legacy at CVCF

Gifts to the Chilkat Valley Community Foundation (CVCF) build the “community permanent fund” for the future. Many friends make their largest contributions through planned gifts, which are invested to grow over time and help CVCF provide grants for our community.

Individuals who include CVCF in their estate plans become members of the Legacy Society for Alaska. It’s a simple, lasting gift to your community. You can:

Make a gift to CVCF in your will or trust.

Designate CVCF as a beneficiary of your retirement accounts or a life insurance policy, which preserves the full value of your support, as your gift will not be subject to estate and income taxes.

Donate a paid‐up life insurance policy.

The Advantages of a Planned Gift to a Fund of the Chilkat Valley Community Foundation

Planned giving means that your assets remain untouched during your lifetime. Bequests are not payable until the time of death. Then, your planned gift lives on to benefit the whole community.

Gifts may be a specific dollar amount, a percentage of your estate after taxes and expenses, or a gift of real property, stocks, artwork, or other valuables.

Planned gifts reduce the taxable value of your estate because CVCF is an Affiliate of a nonprofit organization.

Designating CVCF as a beneficiary of your retirement preserves the full value of your support, as your gift will not be subject to estate and income tax.

Contact us at chilkatvalley@alaskacf.org to discuss your options or for more information on how your planned gift will leave an enduring legacy for the Chilkat Valley.

Bequests can be made to:

The Alaska Community Foundation/Chilkat Valley Community Foundation – Fund Name

EIN #92‐0155067, a tax-exempt organization under IRS Section 501(c)(3)

Additional Resources

Legacy Society for Alaska members for the Chilkat Valley include:

- James Alborough & Sarah “Tigger” Posey

- Mark Battaion & Kristin Hathhorn

- Cindy Buxton

- Matthew Craig and Terry Mulligan

- Steven F. Cunningham & JoAnn Ross Cunningham

- Laurie Dadourian

- Thomas B. Ely

- Dennis Geasan

- Vince & Jansy Hansen

- Tom Henderson

- Tom & Liz Heywood

- Frank & Ramona Holmes

- Bill Joiner & Linda Van Houten

- Jim & Anna Jurgeleit

- Mark “Diz” Kistler & Mardell Gunn

- Jeanne Kitayama

- Julie Korsmeyer

- Larry & Ellen Larson

- Chip & Heather Lende

- Russ Lyman & Cynthia Allen

- Deborah Marshall

- Tim McDonough & Ann Myren

- Sharon Resnick

- Glen and Marcia Scott

- Ron Stotz & Nancy Bandy

- Anonymous (3)

Bequests Received

- Margaret Piggott (2024)

- Alexandra Melanie Feit (2021)

- Lucy Harrell (2020)

- Alan Traut (2020)